Non-dom U-turn would keep South African billionaire in UK

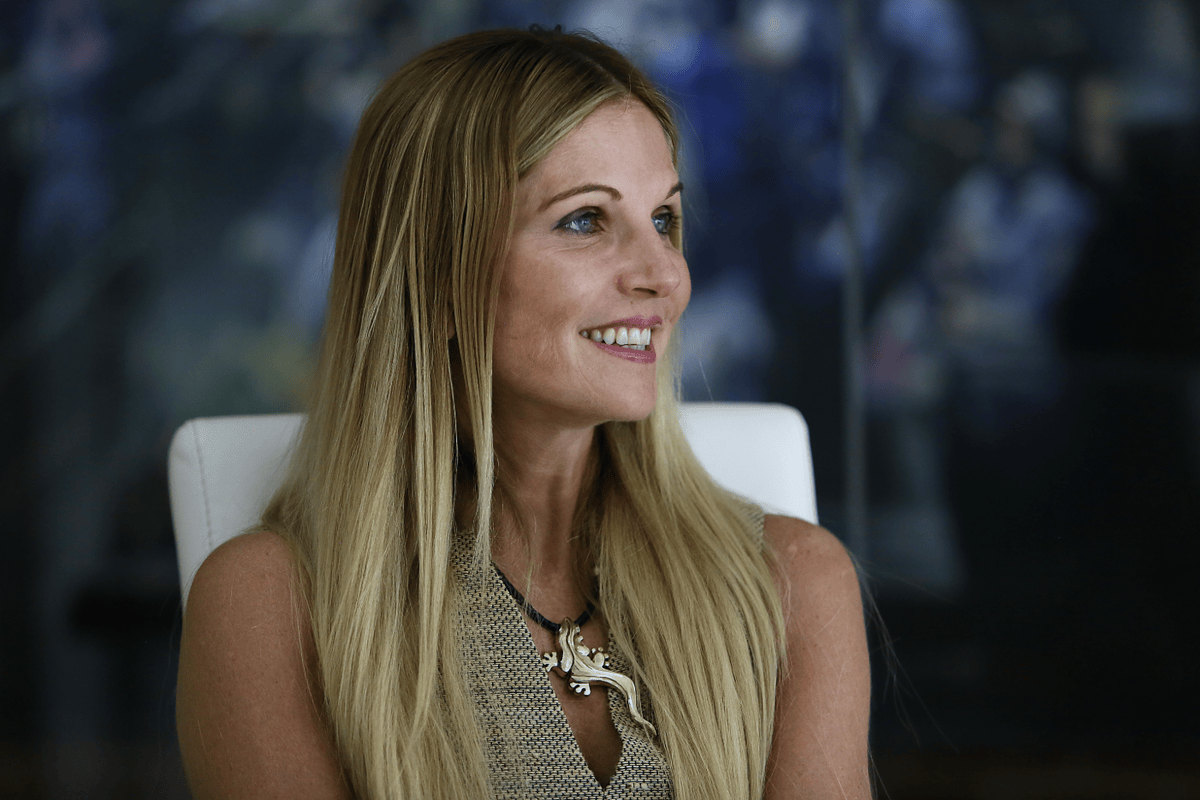

South Africa’s richest self-made woman would cancel her plans to leave Britain if Rachel Reeves goes ahead with a change to non-dom inheritance tax rules said to be under consideration by the Treasury.

Magda Wierzycka, the billionaire entrepreneur behind UK venture capital fund Braavos, had intended to join the wave of rich foreigners departing Britain, but told City AM she would change her mind if the Chancellor U-turned on her decision to apply inheritance tax (IHT) on non-doms’ global assets.

“I would absolutely stay,” she said. “And it’s not about protecting my money from the tax man. I pay all my taxes, but South Africa has foreign exchange controls and I don’t know whether [my estate] would be able to pay the IHT bill under the current rules.”

City AM understands that the Treasury is looking at a range of options to stem the wave of wealthy foreigners departing Britain in response to the government’s crackdown on non-doms announced in the last Autumn Budget.

Among the more radical options on the table is a U-turn on the Chancellor’s decision to make non-doms’ worldwide assets liable to IHT, including those held in foreign trusts.

The Office for Budget Responsibility has estimated the original measure, which came into force in April alongside the abolition of the non-dom regime, would bring just £200m a year for the Exchequer. But tax advisers have held it up as the main factor behind the exodus of wealthy foreigners from the UK.

“The inheritance tax change is perceived by many as the most contentious aspect of the non-dom reforms,” said Anthony Whatling, managing director at City auditor Alvarez and Marsal. “If the government wants to keep wealth – and the business that follows – in the UK, this is the lever it needs to pull.”

Non-dom exodus ramps up

Several high-profile wealthy foreigners have quit the UK in the wake of the government’s change, including the billionaire steel magnate Lakshmi Mittal and top Goldman Sachs banker Richard Gnodde.

The wave of departures has sparked speculation from experts that the tax hike – originally slated as raising £33bn over five years – may ultimately cost the Exchequer money. Former Treasury economist Chris Walker, used a recent paper that advocated for the IHT exemption to warn the exodus would create a “black hole in the public finances“.

Responding to the rumoured reversal from the Treasury, Walker told City AM: “IHT seems to be the straw that’s breaking the camel’s back and causing non-doms to leave. I don’t believe the current position is maximising tax revenues from non-doms, which would have been one objective of the reform.”

Leslie Macleod-Miller, the chief executive of lobby group Foreign Investors for Britain, said: “The government may have finally begun to understand that such draconian UK taxes levied upon overseas assets will only lead to capital flow, businesses closing, philanthropy ending and intellectual capital leaving the UK for good.”

Wierzycka, who also co-founded African investment management firm Sygnia, has previously said she planned to return to her native South Africa in response to the measures in the Autumn Budget.

And speaking to City AM on Tuesday, she added that her venture capital firm Braavos, which owned a 13 per cent stake in quantum computing unicorn Oxford Ionics before it was sold to US rival IONQ last week, would be more likely to raise a fourth funding round were she to stay.

“I have investors who would put money into our fourth fund, but who want me to be in the UK, as it’s me who has the relationship with them,” she said.

A spokesman for the Treasury said: “The government will continue to work with stakeholders to ensure the new regime is internationally competitive and continues to focus on attracting the best talent and investment to the UK.”