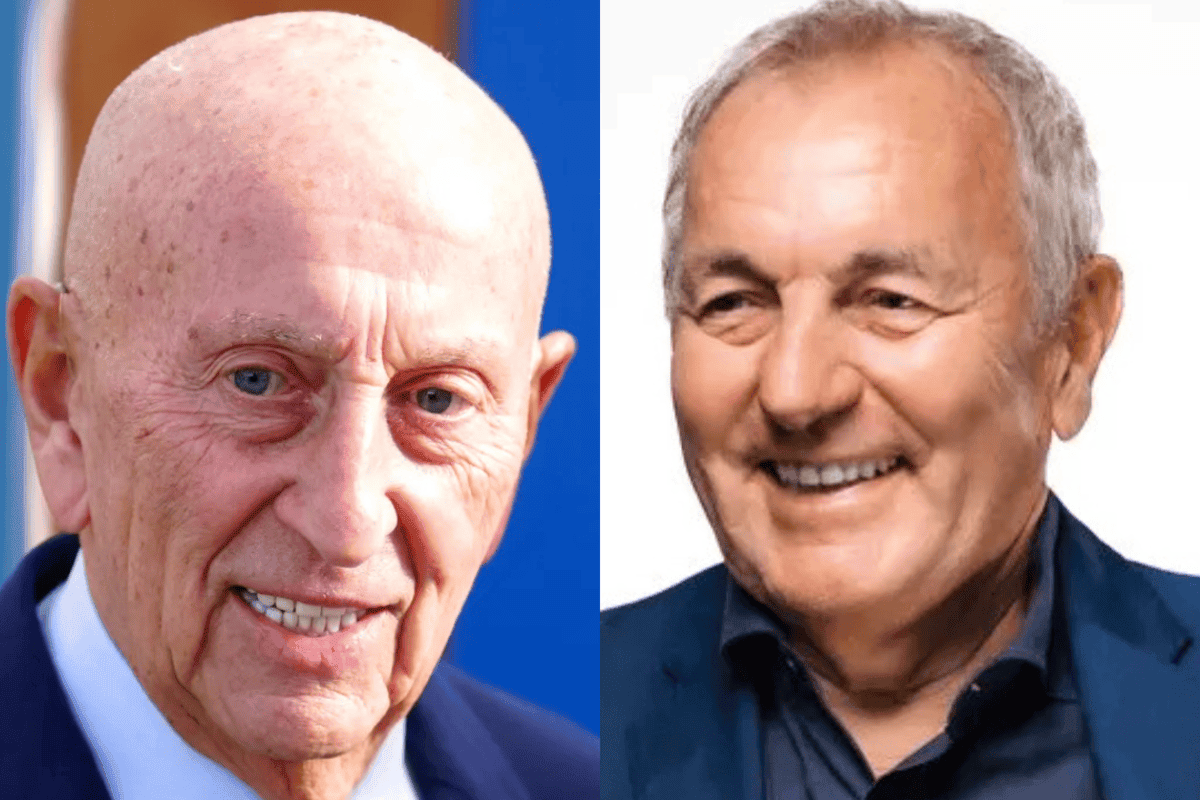

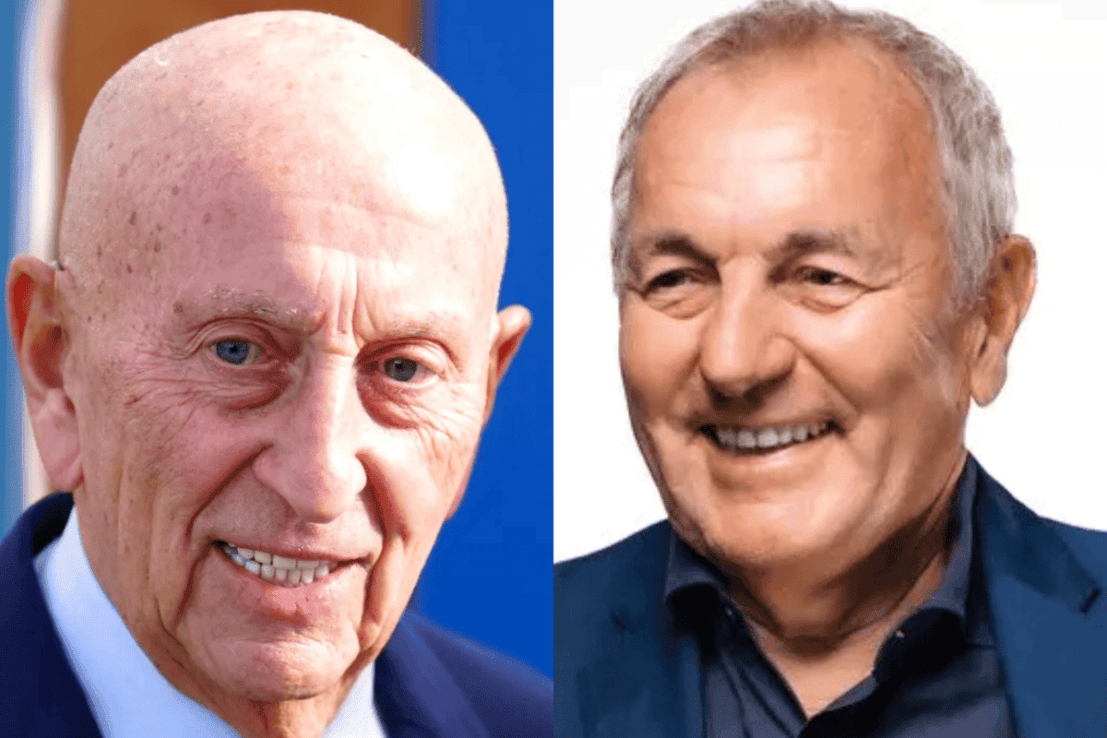

Betfred billionaire brothers share huge Peninsula pay day

The billionaire founders of betting giant Betfred have shared another bumper payday after the continued success of HR giant Peninsula.

Founded by Peter Done in 1983, the Manchester-headquartered group provides services for the likes of the Co-op, Fred Perry, David Lloyd, Dreams and PayPal.

The group is run by Peter Done and is a separate entity to Betfred, which is controlled by his brother, Fred.

However, both billionaire brothers and Fred Done’s daughter Nicola Done-Orrell are shareholders in Peninsula and have shared a huge payday for the second year in a row, thanks to the group’s continued financial success.

The shareholders received a dividend of £62m for the year to 31 March, 2025, new accounts for Peninsula have revealed.

The total is down slightly from the record £65.5m they handed themselves in the prior 12 months.

The inflated dividend in the last two years comes after Peninsula issued pay days between £42m and £47m between 2019 and 2023 and £23m in 2018.

Peninsula last issued a dividend in the year to 31 March 2017.

According to the latest Sunday Times Rich List, the Done brothers’ wealth totalled £2.9bn, up £535m from 2024.

The latest large dividend has been issued on the back of Peninsula’s revenue increasing to £425.6m from £463.1m during its latest financial year.

New accounts filed with Companies House also show how its pre-tax profit went from £88m to £91.9m over the same period.

Over the year, Peninsula increased its headcount from 3,486 to 3,895.

As well as Peninsula itself, the group’s brands include BrightHR, Irwell Law and Croner.

Budget tax hikes impact Peninsula

A statement signed off by the board said: “The group reports another period of growth for the year ended March 2025, building on its year-on-year track record of increasing revenue and profits.

“This was delivered in the context of another year of global economic uncertainty, albeit with easing inflation and interest rates slowly reducing.

“In the UK Budget announcements, such as the changes to employer National Insurance contributions, had an influence, while more global the impact of the US elections and subsequent new administration played its part in creating disruption across regions.”

Peninsula said the increase in its revenue was mainly because of its client base growing by around eight per cent to more than 150,000.

However, the group added that its cost base “also grew at a faster pace than desired” because of the rise in its headcount, inflation and further investment in sales and marketing.

Betfred’s performance to be revealed

Fred and Peter Done, as well as Nicola Done-Orrell, are also shareholders in Betfred, the betting giant the brothers co-founded in 1967.

The accounts for the Warrington-headquartered group, made up to 31 March 2025, are due to be filed with Companies House by the end of this month.

For the 12 months to 1 October, 2023, Betfred reported a turnover of £907.9m, up from £723.2m.

However, it went from making a pre-tax profit of £37.7m to a loss of £35.8m.

In those accounts, the Done family did not pay themselves a dividend but did share a £50.7m payday in the prior 12 months.

In the lead up to the Budget, Fred Done hit the headlines after saying Betfred could close its betting shops if Chancellor Rachel Reeves carried out a tax raid.

Speaking to BBC News, Done said tax rises as the “biggest threat” to the industry he has seen in his 57 years in the sector, echoing similar warnings from other leading gambling companies.

Reeves had previously argued that there “is a case for gambling firms paying more” adding “they should pay their fair share of taxes and we will make sure that happens”.

That followed increasing pressure from former Chancellor and Prime Minister Gordon Brown who has called the sector “undertaxed”.

The gambling industry was one of the biggest losers of the November Budget, hit by a sharp rise in duties paid on its takings in order to raise north of £1bn a year by 2029.

General betting duty on sports bets was hiked from 15 per cent to 20 per cent for punts made online while duty on online gaming was increased from 21 per cent to 40 per cent.

Bets made at physical bookmakers and at horse racing events were exempted from the increase.